Three distinguished speakers share first-hand experiences with MAPFE students through online talks

The Master of Arts in Personal Finance Education (MAPFE) programme regularly invites industry experts to share their knowledge and experiences with our students. In the first half of 2022, we were honored to have three distinguished guests from the sector share their insights on various financial topics with us.

In the online seminar held on 28 February, Mr Edwin Cheung, Vice Chairman of the Institute of Financial Planners of Hong Kong (IFPHK), shared with our students recent developments in the wealth management industry within the Greater Bay Area (GBA), and highlighted the huge growth potential of the industry in Hong Kong.

With more than 16 years of work experience in the financial planning industry, Mr Cheung said it is vital to cultivate a pool of talents with cross-border financial management expertise to support the growth of the GBA. He added that with the rapidly rising number of high-net-worth individuals in the region, nurturing a wealth of professionals to provide a full range of high-quality financial services to these customers will significantly boost the development of the region’s wealth management business. In the seminar, he also introduced the Certified Financial Planner (CFP) Certificate to our students.

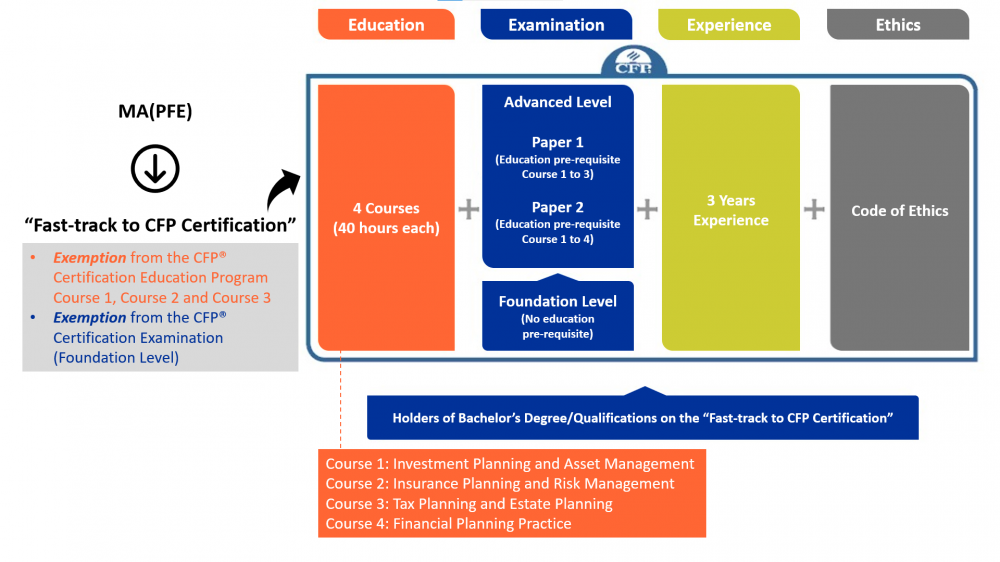

Dr Tang Weiqiang, programme leader of MAPFE and an Associate Professor in the Department of Social Sciences, said IFPHK has confirmed that graduates from the MAPFE programme are eligible to apply for the “Fast-track CFP Certification” - List C candidacy. Under the fast-track arrangement, the MAPFE graduates will be exempt from taking the CFP certification education programme (courses 1 to 3) and the CFP certification examination (foundation level).

On 7 April, the MAPFE programme invited Mr Peter Yau from the Investor and Financial Education Council (IFEC) under the Securities and Futures Commission (SFC) to give an online lecture to our students. In his sharing entitled “Smart Investing”, Mr Yau spoke about how to accumulate wealth, outlining five steps people need to take before making an investment decision. He also listed an array of criteria for judging a good investment.

Over the past decade, environmental, social and governance (ESG) issues have come under the spotlight in the corporate sector. To enrich our students’ understanding about these issues, we invited Mr Anthony Cheung, a specialist in green and sustainable investments in Asia, to give a talk entitled “ESG Analyst certificate and the importance of ESG investment in the Hong Kong finance sector” on 5 May. The Certified ESG Analyst (CESGA) programme by the European Federation of Financial Analysts Societies (EFFAS) is an internationally recognised certificate for ESG professionals. Mr Cheung is the EFFAS’s regional expert and is also a CESGA programme examiner.

As the demand for financial talents in mainland China and Hong Kong steadily expands, graduates from the MAPFE programme have a wide range of employment opportunities. Dr Tan said, “To better prepare our students for their future work, the programme will continue to invite external experts to share with us their practical and first-hand experiences accumulated through long years of working in the business and financial sector.”